|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Top Home Equity Loans: A Comprehensive Guide for HomeownersHome equity loans have become a popular financial tool for homeowners seeking to leverage the value of their homes. These loans provide a way to access funds for various needs, from home improvements to debt consolidation. Understanding the nuances of top home equity loans can help you make informed decisions. What are Home Equity Loans?Home equity loans are secured loans that allow you to borrow against the equity you have built in your home. They often come with fixed interest rates, making them a stable option for those who need a lump sum of money. How Do They Work?When you take out a home equity loan, you receive a lump sum of money, which you then repay over a fixed term. The loan amount is based on the difference between your home’s current market value and your outstanding mortgage balance. Benefits of Home Equity Loans

Choosing the Right Home Equity LoanChoosing the right home equity loan involves comparing different lenders and understanding the terms they offer. Look for competitive interest rates and favorable repayment terms to suit your financial situation. Factors to Consider

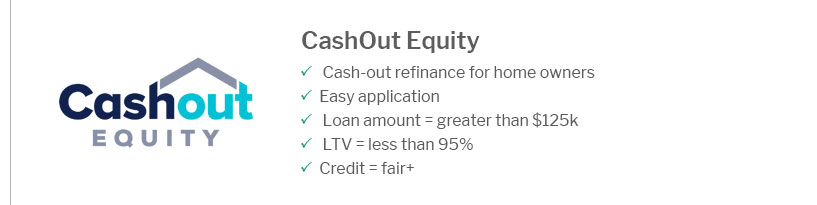

Alternatives to Home Equity LoansWhile home equity loans are a great option for many, there are alternatives worth considering, such as home equity lines of credit (HELOCs) and refinancing options. Home Equity Line of Credit (HELOC)A HELOC provides more flexibility than a traditional home equity loan. It acts like a credit card, allowing you to borrow and repay as needed. This can be beneficial if you anticipate varying financial needs over time. Mortgage RefinancingRefinancing your mortgage may offer better terms and rates. Exploring current mortgage rates il can give you insights into potential savings through refinancing. FAQWhat is the difference between a home equity loan and a HELOC?A home equity loan provides a lump sum with fixed interest rates, while a HELOC offers a revolving line of credit with variable rates. Can I use a home equity loan for any purpose?Yes, funds from a home equity loan can be used for various purposes, including home renovations, debt consolidation, or major purchases. Are home equity loan interests tax-deductible?Interest on home equity loans may be tax-deductible if the funds are used for home improvements, but it’s best to consult with a tax professional. https://www.lendingtree.com/home/home-equity/

Our best home equity loan lenders of 2025 - Best home equity loan for low credit scores: Rocket Mortgage - Best home equity loan for high LTV ... https://www.nerdwallet.com/best/mortgages/home-equity-loan-lenders

See NerdWallet's picks for the best home equity loan lenders and find one that fits your needs. https://www.cnbc.com/select/best-home-equity-loan-lenders/

Best home equity loan lenders of 2025: Rocket, Discover and TD Bank are among our top picks for home equity loans.

|

|---|